Heijmans’ Tax policy, approved by the Heijmans N.V. Executive Board on 10 January 2023 and reviewed once every two years, aims to establish principles and provide direction regarding tax behaviour for all entities controlled by Heijmans N.V. (‘the Group’). With this policy, we safeguard Heijmans’ integrity and reputation in the long term. These principles are important to us and are also supported by our overall strategy and sustainability strategy.

Heijmans’ fiscal code of conduct provides guidance and direction, is not voluntary and applies to everyone involved with Heijmans: the Executive Board, our (temporary) colleagues, our partners, subcontractors and suppliers. If Heijmans employees are confronted with tax dilemmas in the performance of their work, the internal reporting procedure described in section 8.3 also applies here.

Heijmans’ fiscal core values

Collaboration

Honest and ethical cooperation on all tax matters with other experts within Heijmans. Ensure fruitful collaborations with relevant stakeholders and maintain a constructive and transparent dialogue based on reciprocity and transparency, without compromising the confidentiality that is part and parcel of business operations.

Ownership

Take reciprocity and solidarity seriously and pay a ‘fair share’ of taxes and comply with all applicable tax obligations in countries and regions where Heijmans operates or will operate.

Result focus

Organise tax matters to achieve the most favourable tax treatment within the limits set by the spirit of the law and in line with the other core values.

Heijmans’ Tax policy

Based on the above core values, all entities that are part of the Heijmans Group have set up their tax governance management by adhering to the following five commitments:

1. Tax compliance

As creators of a healthy living environment, we know better than anyone how important it is to contribute to the general amenities in the countries and regions where we operate or will operate in the future. This is why Heijmans feels a high level of responsibility to pay a ‘fair share’ of taxes. Heijmans does this on the basis of the following principles:

-

Tax follows the business. Tax positions are taken on the basis of sound business principles and by refraining from aggressive tax structures aimed at avoiding or evading tax. Should Heijmans become active outside the Netherlands in the future, in principle this will not be in countries on the European Union’s black list.

-

We follow both the letter and the spirit of the law.

-

We apply the arm's length principle in intra-group transactions.

-

We disclose complete and accurate information on our activities in a timely manner and refrain from structures that hide and/or reduce transparency.

-

We expect any advice given by our (tax) advisers to be in compliance with the above principles.

2. Tax efficiency

Heijmans must pay tax, but will try to limit its tax burden wherever possible. In other words, within the limits of the other four obligations and more specifically the first obligation, Heijmans aims to create value through effective management of tax expenses and legitimate use of tax benefits, exemptions and/or subsidies.

3. Tax certainty & comfort

Heijmans strives to develop strong and reciprocal relationships with local tax authorities based on transparency and trust. All of this with the aim of achieving the correct application of the law, increasing legal certainty and reducing disputes. To this end, Heijmans applies the following principles:

-

In the event that tax legislation is unclear or subject to different interpretations, Heijmans Tax department obtains written advice.

-

We provide the tax authorities with all necessary information and relevant documentation as quickly as possible.

-

Dialogue takes precedence over dispute. We have a strong preference for resolving disputes in an atmosphere of mutual consultation - if possible - by focusing on constructive consultation and building sustainable relationships with relevant tax authorities.

-

In the event of new and/or amended legal and regulatory requirements, Heijmans representatives promote our interests with (local) authorities through industry associations, in compliance with our fiscal code of conduct.

-

We build up a case file in defence against disputes and conflicts relating to differences of opinion and the interpretation of tax legislation, but always with the primary aim of reaching an amicable settlement and/or solution.

4. Tax risk management

Heijmans currently operates almost exclusively in the Netherlands. Nevertheless, the current public debate regarding the tax policy of multinationals and Heijmans' public sector clients give us all the more reason to identify and manage our tax risks.

Heijmans is exposed to the following tax risks:

-

Tax compliance & reporting risks. These risks include late or incorrect filing of tax returns, late or incorrect claiming of exemptions or reliefs, and financial or operational systems and processes that are not robust enough to support compliance & reporting obligations. Heijmans’ risk appetite for tax compliance & reporting risks is low.

-

Transactional risks. The risk of undertaking (legal) actions without first identifying the tax consequences, or tax planning that is not properly implemented. Heijmans’ risk appetite for transactional risks is low to medium.

-

Reputational risks. This includes the overall impact that tax-related business operations may have on our relationships with stakeholders, clients, tax authorities and society. Heijmans’ risk appetite is moderate. In the event of an uncertain tax position, we take a defensible position (‘more likely than not’).

Heijmans manages its risks on the basis of the following principles:

-

Tax risk management is an integral part of the Heijmans risk policy. This means that the Heijmans Tax department should be consulted in advance to determine the tax consequence of significant business transactions.

-

Heijmans sets up and manages the Tax Control Framework and Risk Matrix per tax asset in close consultation with the Tax Authorities under an Individual Supervision Plan (Horizontal Supervision).

-

We contribute to compliance and optimisation of tax processes, including the use of automation software and technology where possible.

-

Maintain and improve the tax knowledge level and signalling function of employees involved in tax processes with respect to compliance with legal and regulatory requirements through internal or external training courses.

-

We prevent surprises by being closely involved in quarterly and annual closures.

-

We inform the Audit and Risk Committee about the implementation of our tax policy (and strategy) and urgent issues, including tax risks, at least once a year.

5. Tax governance

The Heijmans Executive Board is responsible for the tax policy (and strategy). The managements of the business areas are responsible for implementing and executing the tax policy. The Heijmans Tax department is the point of contact for all tax-related matters. The Heijmans Tax department consists of highly trained tax experts who are in continuous dialogue with internal and external stakeholders. The Heijmans Tax department reports periodically to the CFO and Group Controller on compliance with the tax policy (and strategy).

Tax contribution report

One of our principles is that Tax follows our business. In short, our business is the design, construction and maintenance of buildings, homes and infrastructure, including related goods and services. This is grouped into the Property Development, Building & Technology and Infra business areas, with a head office in Rosmalen and office locations spread across the rest of the Netherlands.

Heijmans currently has almost no activities abroad and all employees, including senior management, are employed in the Netherlands. This fact is important in understanding the tax position of the Heijmans business model and the reason why 100% of the result achieved with our business model is allocated to the Netherlands [1]. In addition to regular consultations, whenever possible we will also reach agreements with the tax authorities on the determination of taxable profit.

Heijmans has tax processes and control measures in place to manage its various tax assets, such as VAT, payroll taxes and corporate income tax. In addition, we perform regular monitoring activities, such as spot checks and internal audits (with or without external parties) to determine whether the control measures are still effective. In addition, we provide relevant employees with regular tax training courses and updates to maintain and improve their tax knowledge level and their signalling function with regard to compliance with legal and regulatory requirements.

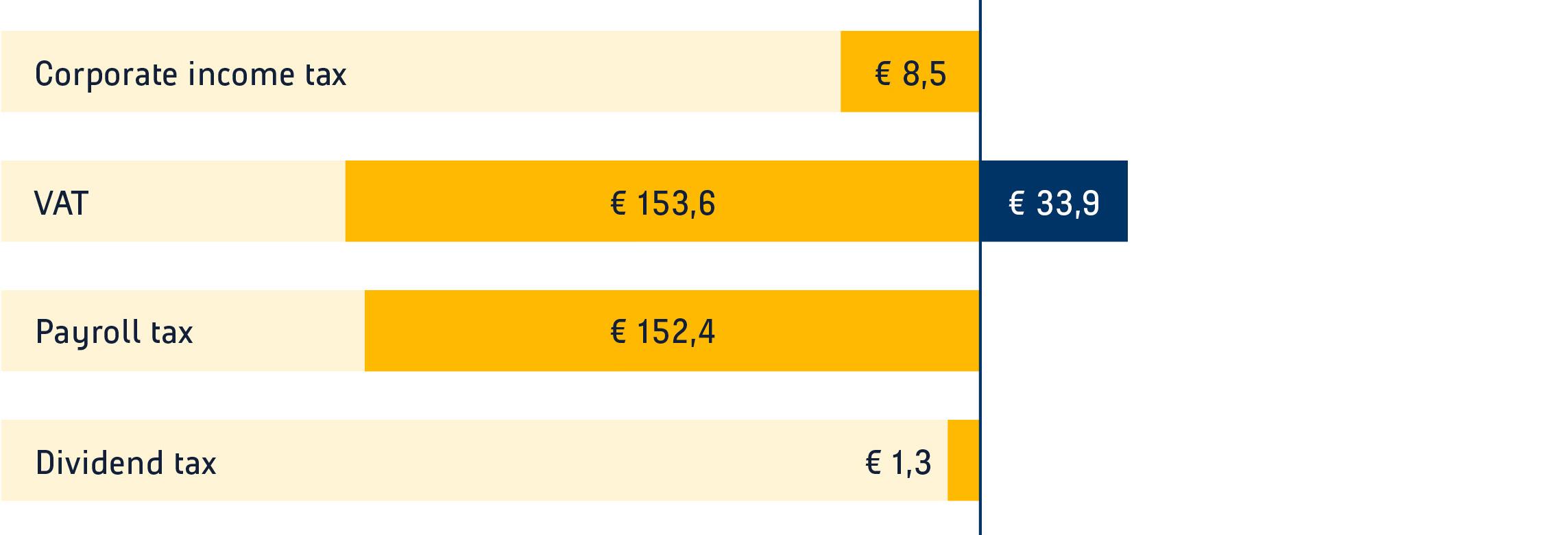

We provide information on tax payments and taxes withheld in the annual financial statements. Heijmans shares an annual country-by-country report with the Dutch Tax Authorities. Below we have included the most important tax data for the Netherlands (100% of operating activities).

- 1Heijmans still has a number of inactive foreign companies in its structure, stemming from past foreign operations and that are currently awaiting liquidation (i.e. ‘dormant’ companies).

|

Fiscal year: 2022 (EUR '000) |

||||||

|

Tax Jurisdiction |

External revenue |

Internal revenue* |

Total revenue |

Pre-tax result |

Income tax paid** |

Tax expense (actual) *** |

|

Netherlands |

1,812,210 |

70 |

1,812,280 |

73,081 |

8,471 |

9,032 |

|

Belgium |

0 |

40 |

40 |

-160 |

0 |

0 |

|

Germany |

0 |

0 |

0 |

-30 |

0 |

0 |

- *Internal revenue refers to cross-border revenue, excluding internal revenue within a jurisdiction.

- **Income taxes paid refers to the actual income taxes paid in 2022.

- ***Tax expense (actual) refers to the total current tax expense, excluding deferred tax liabilities/assets. The deferred tax liability is significant given accumulated past losses that can be partly offset against taxable profits.

- *This overview represents Heijmans N.V. and all its 100% (in)direct subsidiaries