Risk acceptance refers to the level of risk that Heijmans is willing to accept or is exposed to in the pursuit of long-term value creation. Risk acceptance involves risk limits. These are determined by the company's culture, corporate governance and management systems, and are set out in our values, code of conduct, policies and procedures and authorisation schedules.

In assessing our risk acceptance, we categorise project risks. These include the annual revenue of a project relative to the company’s revenue, the form of contract, the client, cash flow, competence ‘fit’, profitability, capacity to do the work and the technical risk profile of the chosen solution. Each project is assigned to a risk project category (1 to 3) based on the above. This classification is based on the principle that the higher the risk profile, the higher the authorisation in the organisation, the higher the return requirements and the more frequent the project monitoring. A workflow and authorisation are automatically linked to the risk project category. Depending on the nature, size and risk profile of a project, it must be approved by the business area management and/or the Executive Board. All projects in the highest risk project category 3 are discussed with the Executive Board and the Chief Risk Officer (CRO). In our view, there is a responsible balance between risk and return when:

-

the project fits - in terms of its nature and size - within the company’s objectives and the required experience, capacity and expertise are available in terms of nature and scope;

-

the client finances the project to be acquired;

-

in the event of unlimited liability, this is manageable at project level and risks are insured where possible and desired;

-

the project is profitable, with a premium for profit and risk appropriate to the risks and form of contract, while projects with a sales risk have higher return requirements;

-

in property development activities, we assess whether a project can be financed. Aspects that play a role in this assessment are the method of financing, the duration and the result to be achieved, taking into account this higher risk profile;

-

in principle, 70% of the real estate project is sold and/or leased before construction starts, in the event that Heijmans bears the risk for the development of the project;

-

for projects that are executed in combination with others (partners), each partner contributes resources in proportion to its contribution, runs a proportionate risk and adds value to the project. Also with a well-founded assessment that the partner can actually bear its share of the risk.

In addition, Heijmans aims for a good balance in its revenue mix, both between and within all of its business areas. As part of the right risk/return ratio for Heijmans, Heijmans’ portfolio has shifted on several fronts in recent years. We take on fewer (very) large projects and more medium-sized projects, we take a critical approach to Design Build Finance Maintain (DBFM) contracts and have more construction team and two-phase contracts, plus a growing share of maintenance projects and services (recurring business) compared to new-build projects. All these shifts have led to a more robust portfolio of projects and services with a lower risk profile. We can see examples of this at Infra, where the ratio between large projects on the one hand and regional projects, specialist activities and asset management contracts on the other is developing in favour of the second risk category (fewer large and more medium-sized projects). At Building & Technology, we aim for a balanced ratio between non-residential projects, residential building, multi-functional high-rise residential construction and service work. At Property Development, we manage the ratio between developments based on our own holdings, tenders/award competitions and existing relationships with clients, also with a good balance between inner-city and suburban projects. Our preference is for development based on our own holdings and a long-term relationship with our customers and clients. We use tenders to supplement the portfolio if this is required.

Heijmans continuously evaluates both project and business risks, its business risk profile and risk appetite, using an integrated CRO report. The Chief Risk Officer prepares this on a quarterly basis and discusses it with the Executive Board and Supervisory Board. The purpose of this report is to provide a picture of how Heijmans’ risk profile is developing. In its business operations, Heijmans distinguishes between risks related to ‘running the business’ and ‘changing the business’. We made this distinction in order to pay specific attention not only to risks, but also to opportunities in terms of future developments in the areas of Better, Smarter and more Sustainable.

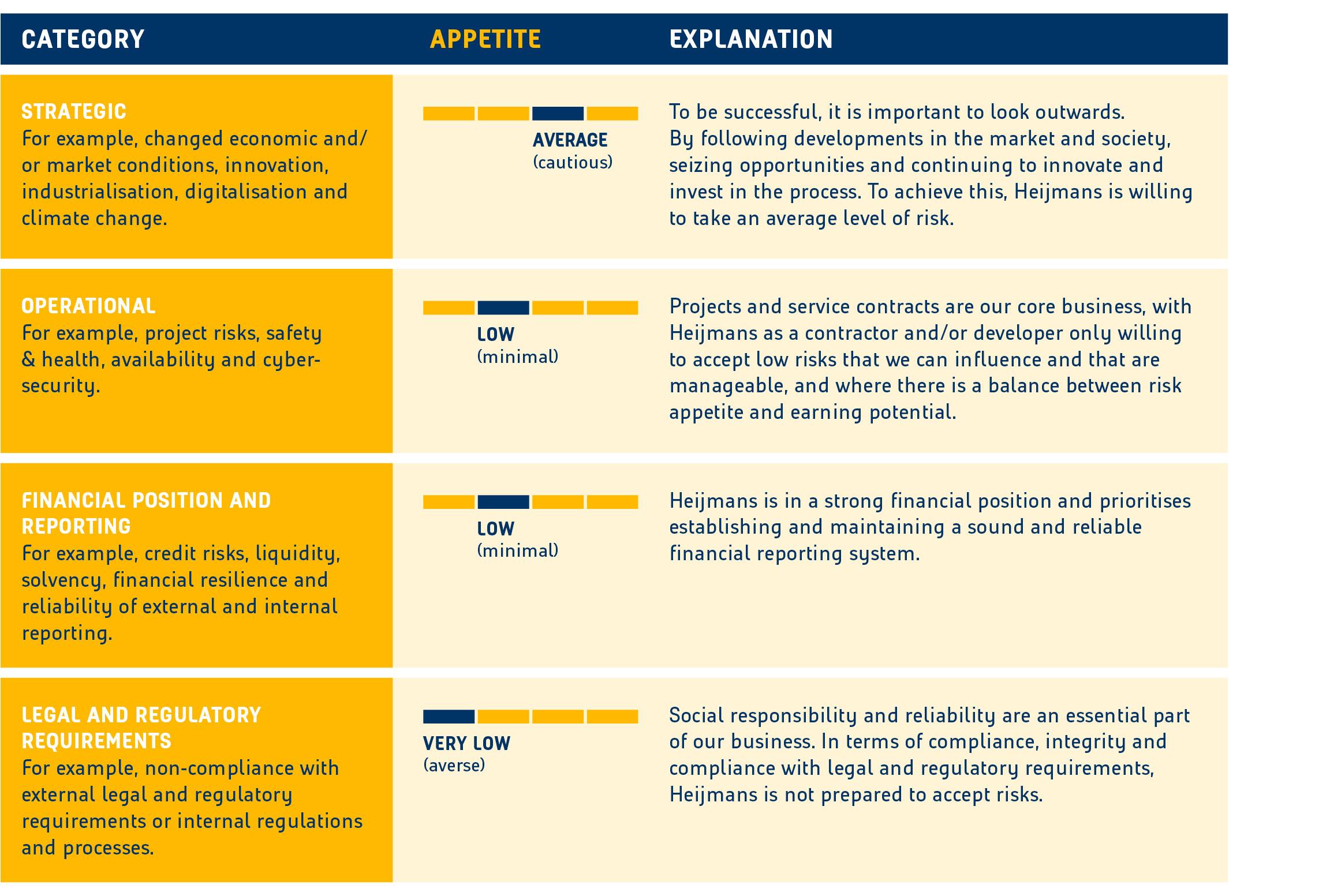

We also divide the business risks broadly into four categories: strategic, operational, financial position and reporting, and legal and regulatory requirements. We do this for both internal and external risks that can have an impact on the company. This gives us a picture of the impact should these risks materialise. Our risk matrix (or heatmap) lists the most significant risks per risk category, the estimate of their likelihood and impact and the control measures we have taken. We determine the potential impact of risks not only on the basis of the financial impact on the company’s value, but also on the basis of the negative impact on our environment (people, environment and society) and our reputation.