Heijmans share capital

The composition of the share capital of Heijmans N.V. as at 31 December 2022 was as follows:

|

Shares x 1.000 |

Authorised capital |

Issued capital |

||

|

2022 |

2021 |

2022 |

2021 |

|

|

Ordinary shares |

35,100 |

35,100 |

23,553 |

22,760 |

|

Cumulative financing preference shares B |

7,000 |

7,000 |

- |

4,510 |

|

Protective preference shares |

8,000 |

8,000 |

- |

- |

|

|

50,100 |

50,100 |

23,553 |

27,270 |

Ordinary shares

The shares are held by the Heijmans Share Administration Trust (SA Trust). The face value per ordinary share is € 0.30. The SA Trust had issued 23,552,919 depositary receipts for shares as at 31 December 2022, and these shares are listed on the NYSE Euronext stock exchange in Amsterdam. The voting rights on ordinary shares are vested in the SA Trust. Each ordinary share entitles the holder to 30 votes. Holders of depositary receipts for shares wishing to vote at a shareholders’ meeting are granted an unconditional proxy by the SA Trust. The movements in the number of ordinary shares and depositary receipts for shares, together with a summary of the key figures per (depositary receipt for an) ordinary share, are presented in the table below.

|

Shares x 1.000 |

2022 |

2021 |

2020 |

2019 |

2018 |

|

|

|

|

|

|

|

|

In issue on 1 January |

22,760 |

21,933 |

21,409 |

21,409 |

21,409 |

|

Issue of share capital |

- |

223 |

524 |

- |

- |

|

Stock dividend |

792 |

604 |

- |

- |

- |

|

Matching shares Share Matching Plan |

|

|

- |

- |

- |

|

In issue on 31 December |

23,553 |

22,760 |

21,933 |

21,409 |

21,409 |

|

|

|

|

|

|

|

|

Average in issue for the year |

23,264 |

22,415 |

21,671 |

21,409 |

21,409 |

|

|

|

|

|

|

|

|

Earnings per share* x € 1,00 |

2.56 |

2.24 |

1.85 |

1.40 |

0.95 |

|

Dividend per share x € 1,00 |

1.01 |

0.88 |

0.73 |

- |

- |

|

Pay-out ratio % |

40% |

40% |

40% |

- |

- |

- *Per average weighted ordinary issued share

Heijmans N.V. is listed on Euronext Amsterdam. The data relevant to the stock market listing is presented in the table below:

|

Heijmans market listing |

2022 |

2021 |

2020 |

2019 |

2018 |

|

|

|

||||

|

Closing price (in €) |

10.12 |

14.90 |

9.33 |

7.50 |

8.00 |

|

High price (in €) |

15.70 |

15.40 |

9.67 |

11.52 |

12.92 |

|

Low price (in €) |

9.19 |

9.26 |

4.47 |

7.12 |

7.44 |

|

Dividend yield at closing price (in %) |

10.0% |

5.9% |

7.8% |

0.0% |

0.0% |

|

Market capitalisation at year-end (in € mln) |

238 |

339 |

205 |

161 |

171 |

|

Average daily turnover (in no. of shares) |

85,316 |

122,852 |

158,183 |

122,598 |

138,608 |

Issued capital and shareholdings

The issued share capital and associated voting rights were last changed in 2022 as a result of the issue of (depositary receipts for) shares in connection with the payment of the dividend on (depositary receipts for) ordinary shares in the form of stock dividend and the cancellation of the cumulative financing B preference shares.

Heijmans made three payments on the cumulative financing preference shares B, charged to the share premium reserve, as at 26 April 2022, resulting from the redemption elements described in section 6.22 of the financial statements in this annual report. These were 1) the amount of the cash dividend coupon, 2) an amount corresponding to 50% of the amount of dividend paid on (depositary receipts for) ordinary shares (whether stock dividend or cash dividend) and 3) an additional repayment related to the level of solvency. In addition, on 28 April 2022 it was agreed with the holders of these shares that Heijmans would voluntarily redeem the share premium reserve remaining as at that date. As a result, the value per cumulative preference B share was reduced from € 6.82 to € 0.21 (the nominal value) and the voting rights as at the contractual adjustment date of 30 June 2022 was 0.0268 per cumulative preference share.

After the Extraordinary General Meeting of Shareholders (EGM) on 12 July 2022 had issued the requisite repurchase authorisation, all 4,510,000 of the issued cumulative financing B preference shares were repurchased by the company on 13 July 2022. Also following a resolution of said EGM, the repurchased shares were withdrawn from the issued share capital with effect from 22 September 2022. As of that date, no financing B preference shares were issued.

Each ordinary share entitles the holder to 30 votes per ordinary share. The composition of the issued capital and associated voting rights was as follows as at 31 December 2022:

|

Issued capital |

(Potential) Voting right |

|||

|

Number |

% |

Number |

% |

|

|

Ordinary shares |

23,552,926 |

100.0% |

706,587,780 |

100.0% |

|

For which depositary receipts issued |

23,552,919 |

100.0% |

706,587,570 |

100.0% |

|

For which no depositary receipts |

7 |

0.0% |

210 |

0.0% |

|

Depositary receipts |

23,552,919 |

100.0% |

706,587,570 |

100.0% |

|

Cumulative preference shares |

- |

0.0% |

- |

0.0% |

|

Total year-end |

23,552,926 |

100.0% |

706,587,780 |

100.0% |

To the best of Heijmans’ knowledge, and also based on the WMZ (Dutch Major Holdings in Listed Companies Disclosure Act) register maintained by the Dutch Financial Markets Authority (AFM), the following investors held an interest of 3% or more in Heijmans as at 31 December 2022:

|

Holdings in Heijmans |

31 december 2022 |

31 december 2021 |

||

|

|

|

|||

|

Capital (%) |

Potential voting right (%) |

Capital (%) |

Potential voting right (%) |

|

|

ASR Vermogensbeheer |

5.7% |

5.7% |

5.2% |

5.9% |

|

Quaero Capital SA |

5.6% |

5.6% |

5.2% |

5.9% |

|

C.A.C.M. Oomen |

5.2% |

5.2% |

||

|

Acadian Asset Management LLC |

4.1% |

4.1% |

3.6% |

4.0% |

|

Dimensional Fund Advisors LLP |

4.0% |

4.0% |

3.6% |

4.1% |

|

Unionen |

3.4% |

3.4% |

3.1% |

3.5% |

|

Kempen Capital Management N.V. |

<3% |

<3% |

7.0% |

1.3% |

|

NN Group N.V. |

<3% |

<3% |

6.1% |

0.3% |

|

JP Morgen Asset Management UK Limited |

<3% |

<3% |

3.0% |

3.4% |

|

|

28.0% |

28.0% |

36.8% |

28.4% |

|

|

|

|||

|

Other holdings |

72.0% |

72.0% |

63.2% |

71.6% |

|

|

|

|||

|

Total |

100.0% |

100.0% |

100.0% |

100.0% |

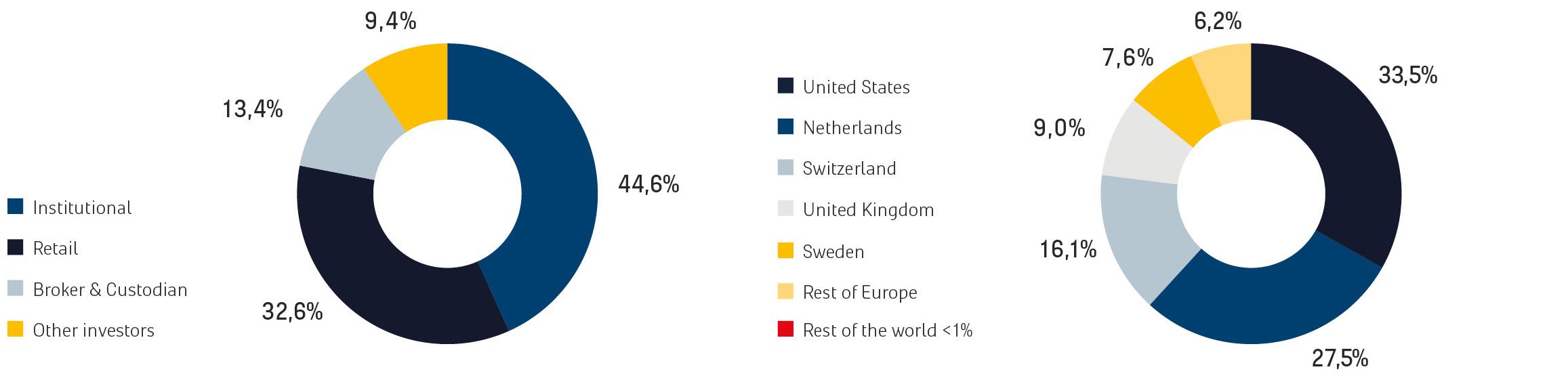

Based on the information provided by banks and custodians and information services, the distribution of share ownership can be broken down as follows:

In the year under review, the (estimated) shareholdings held by institutional investors probably increased slightly to 44.6% (2021: 44.1%). An estimated 33.5% of the number of depositary receipts for ordinary shares held by institutional investors is held in the Netherlands (year-end 2021: 24.3%). The increase among Dutch shareholders was accompanied by a particularly visible decline among UK institutional investors. We estimate that the majority of the depositary receipts for ordinary shares held by retail investors are held in the Netherlands.

Share price development

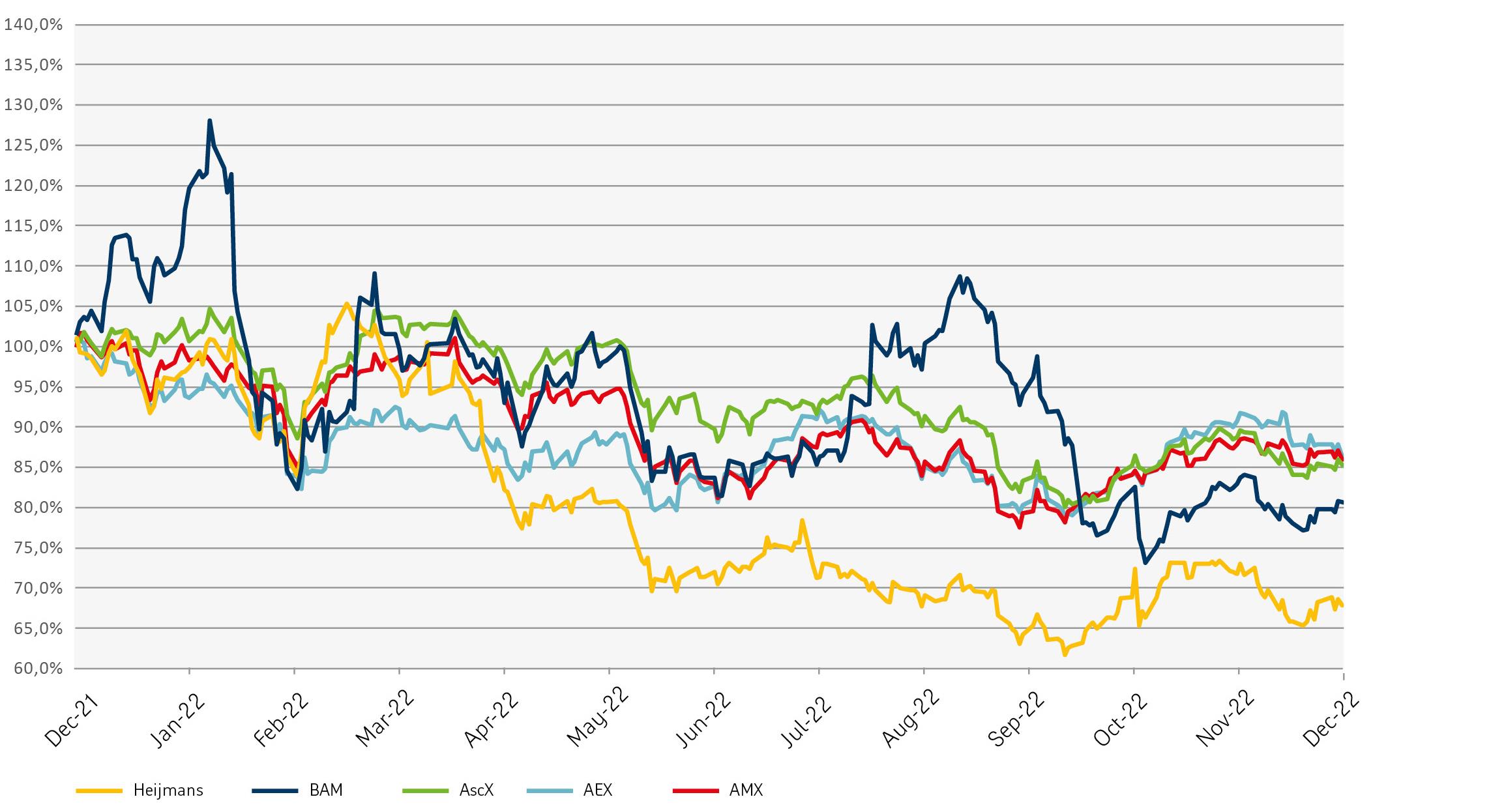

The closing price of the ordinary shares was € 10.12 at year-end 2022. This was a decline of 32% compared to the closing price at the end of the 2021 financial year (€ 14.90), which was a worse performance than the AscX index, which fell 15% in the same period. Despite the fact that Heijmans repeatedly reiterated its result forecast during the year and also publicly announced that the Porthos case ruling on the nitrogen emissions issue had no material impact, the share price suffered from the poor sentiment on the housing market in particular. The chart shows the Heijmans share price movement in 2022 compared to the AscX index, the AEX and the AMX, as well as to the other Dutch listed construction company BAM.

Financial calendar 2023

Heijmans has set the following (publication) dates for 2023:

|

Date |

Event |

Time |

|

17 februari 2023 |

Publication results 2022 |

Pre-market |

|

3 april 2023 |

General Meeting of Shareholders |

14.00 |

|

5 april 2023 |

Ex-dividend date |

|

|

25 april 2023 |

Trading update |

Pre-market |

|

28 juli 2023 |

Publication interim results 2023 |

Pre-market |

|

1 november 2023 |

Trading update |

Pre-market |